This has been happening at breathtaking speed in recent days, and it’s a tectonic shift in global politics that will have major ramifications.

The war in Ukraine means that Russia has now completely cut itself off from the American empire. This means that Russia will no longer sell its oil and gas in US dollars. Both Russia and China have long prepared for this day and have developed their own SWIFT systems (SWIFT is intimately connected to the petrodollar, yet it’s a separate strand that I might get into another time).

We had this rather unbelievable headline this week…

I know financial stuff makes a lot of people’s eyes glaze over (mine included), yet I’m going to try and give a concise as possible explanation - for those not familiar with this stuff - of why the above news story is quite mind blowing:

Gross domestic product (GDP) is a monetary measure of the value of all final goods and services produced within a state in a given year. Here’s the top 10 countries in terms of GDP, with the European Union shown first, because as an economic block it has the highest GDP in the world. The figures shown are in millions of US dollars (ie, trillions):

European Union $18,527,116

- United States $17,348,075

- China $10,356,508

- Japan $4,602,367

- Germany $3,874,437

- United Kingdom $2,950,039

- France $2,833,687

- Brazil $2,346,583

- Italy $2,147,744

- India $2,051,228

- Russia $1,860,598

You might notice that the GDP of the United States is not that far behind the GDP of the European Union. The US has a large population and a lot of natural resources; but there again, so do China, Brazil and Russia. So why is US GDP so disproportionately high…? One word: petrodollars (although some will no doubt argue with me on this). To explain petrodollars you have to go back to the Bretton Woods Agreement, in 1944, which established the US dollar as the world’s reserve currency, backed by US gold reserves. However, by the end of the 1960s, expenditures on the Vietnam war made it apparent to many countries that the US was printing far more money than it had gold. Nations began to panic and demanded that the US give them gold for their dollars. The situation came to a head in 1971 when France attempted to exchange its dollars for US gold and President Nixon refused.

This default on the gold standard led to a rapid decline in the value of the US dollar. Uncle Sam needed to do something about it, and so in the early 1970s one of the strangest, most bizarre financial deals ever was struck between the USA and Saudi Arabia. It’s called the ‘petrodollar’, and it meant that Saudi Arabia, followed by the other OPEC states, would only sell oil for US dollars, and they would invest any excess oil profits in US Treasury bonds, notes, and bills. In return, Saudi Arabia and the Gulf states would be protected by the US military (most notably from Israel).

The petrodollar agreement was struck between President Nixon and King Faisal of Saudi Arabia in 1973. For the US it was a ‘Died and gone to Heaven’ kind of deal. With all the world’s oil now being sold in US dollars it created a strong demand for the currency, pushing up its value immensely. As the printer and issuer of the dollar, the US was effectively able to buy oil for nothing. All OPEC profits went into the US financial system. As a result of all this the US economy soared. If you’ve ever wondered how on Earth the US (and UK) can have such close relations with totally vile regimes like Saudi Arabia, there’s the answer.

There was a downside to the petrodollar, though. Countries now needed dollars to buy oil. There were two ways of getting them: either buy them from the US, at a mark up, or else manufacture goods and export them to the US in exchange for dollars. As a result, the US was flooded with cheap imports (remember all those Japanese cars, for instance) and a huge number of manufacturing jobs were lost in the US.

With the collapse of the Soviet bloc in the early 1990s the US became the sole superpower (in money terms, not in terms of nuclear weapons) and instead of embracing a new era of peace it aggressively defended its hegemony, including the petrodollar. In 2000 the Iraqi president, Saddam Hussein, started making noises that in future he would sell Iraqi oil in Euros (prompted by France and a few other EU members). In 2001 we had 9/11. In 2002 Iraq started selling its oil in Euros. In 2003 the US invaded Iraq on the flimsiest of pretexts. One of the first things the American occupiers and their puppet government did was to bring back the petrodollar. At the time the Euro was relatively strong against the dollar, and by selling its oil in dollars Iraq was losing 20% of the value of its oil.

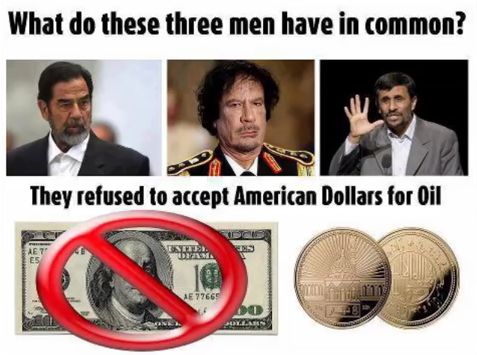

Also during the early 2000s countries such as Russia, Iran, Indonesia and Venezuela were talking about abandoning the petrodollar. This slide was halted by using sanctions and threats of freezing assets, and of course the example of Iraq. When it comes to wars in the Middle East, “It’s all about oil” is an often heard refrain. As far as the USA goes, it’s not about oil per se (with fracking the US is now self-sufficient in energy), it’s about the currency that oil is sold in, and the free ride that the petrodollar gives the US. Look at Libya, an oil rich country and its biggest producer in Africa. In 2010 Colonel Gaddafi started selling oil for gold instead of petrodollars. We all know what happened to Gaddafi, and although Libya is now in chaos it will come as no surprise that the country’s oil is now being sold in petrodollars again.

This brings us on to the present, where countries such as Russia, China and India have recently abandoned the petrodollar and are now selling oil in their own currencies. This is mega stuff, because unlike Libya, et al, these countries are too big/powerful to be pushed around by the USA and its totally corrupt/incompetent war machine. This means the end of the petrodollar and US world hegemony; and the 64,000 petrodollar question is, how will the USA react to this? Well, thesedays the USA is largely run by batshit crazies backed-up by a totally presstitute news media, so I’m afraid that things do not bode well. What’s going on in Syria right now is a good example of this (Syria is an oil producer which also wants to abandon the petrodollar). The key here is the total disconnect between reality and what the public in the West are told by politicians and presstitutes, such as this total bullshit.

During the collapse of the Soviet Union in the late 1980s and early 90s the world went through a very dangerous period, that thankfully didn’t lead to major war and conflict. Now, with the imminent collapse of the United States of America, arguably the most corrupt and violent nation that’s ever existed, the world is going through a crisis of historic proportions. Let’s just hope that sane heads prevail in Moscow and Beijing. There’s certainly no sane heads in Washington at the moment.

NB: I wrote the bulk of this piece back in 2016, and as a result a lot of the links I give will have gone down the Memory Hole (Winston is kept very busy thesedays). It still stands-up to give some idea of what’s happening in 2022.